While the overwhelming majority of our customers meet their payment obligations, there is a small portion of debt that must be closely managed.

Our objective is to manage the recovery of debt in a thorough and timely manner so that outstanding liabilities are paid.

We are currently developing some online capabilities for our Land Tax customers to make it easier for debt customers to manage payment of their debt online. This should bring significant improvements in customer experience and it is hoped that this functionality will be delivered in the latter part of 2018-19.

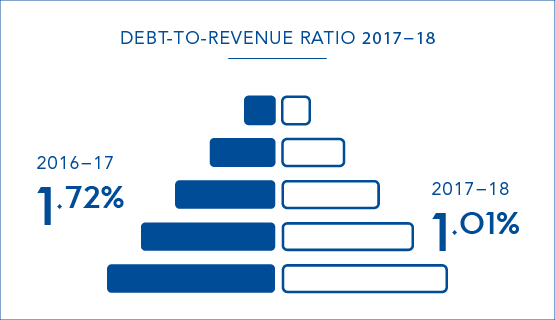

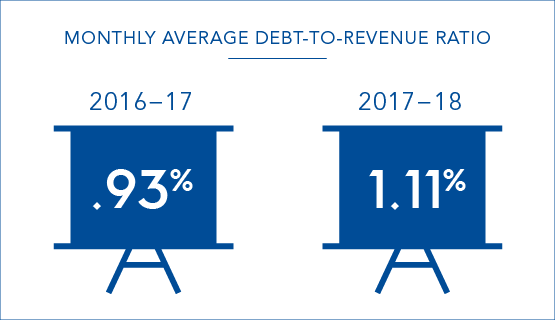

In real terms our debt level is consistently below 2 per cent of total annual revenue collected, reflecting our high performance standards in managing debt and keeping it at low levels.

This year, we achieved our debt-to-revenue ratio target despite an increase in the value of total receipts. In addition, the debt-to-revenue ratio result at 30 June 2018 was considerably lower than 12 months ago.

We also maintained our focus on resolving smaller value, but larger volume, land tax debts, resulting in the continued resolution of older debt cases.