Given we operate within a busy, tax technical environment, and have a large customer base, we are proud that our customer satisfaction rating remains a high 96 per cent.

We are committed to maintaining this by providing the best services we can, including those that assist and educate our customers to understand their obligations in relation to the taxes and benefits we administer.

Our technical experts strive to ensure that the complexities of the taxation legislation we administer are clearly and concisely communicated at all levels.

Although we offer a wealth of information and tools on our website, which continues to see significant growth, with a 112 per cent increase in page views this year, our Customer Contact Centre continues its important role in helping customers with complex problems or those who prefer telephone contact.

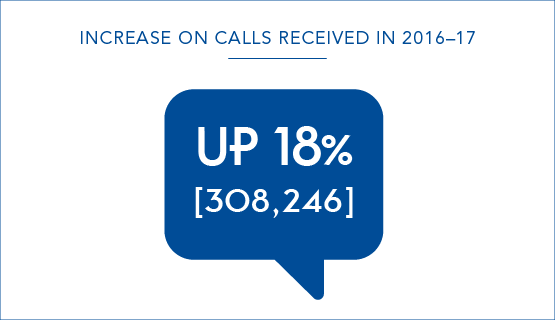

In 2017-18, our Customer Contact Centre received 376,366 phone calls for assistance, an increase of 18 per cent on 2016-17.

Customer education

We provide a range of online and face to face programs designed to increase customer understanding of the taxes, grants, exemptions and concessions we administer.

Our website provides a wealth of information and our regular webinars and library of videos ensure people can access information no matter where they are located and at times and in formats suiting them.

In 2017-18, we:

- Welcomed 3384 people to 195 interactive webinars.

- Presented information to 2192 people attending 64 face to face presentations with Victorian business, industry groups and peak customer bodies.

- Added 17 new videos to our already extensive online video library, with topics including vacant residential land tax, how to create AutoPay Instalments, understanding land tax assessments, and exploring various aspects of payroll tax.

- Facilitated quarterly meetings of the State Taxes Consultative Council involving senior industry stakeholders and peak professional bodies representing business.

- Delivered public education seminars on tax provisions to legal and tax practitioners.

We also continued developing our suite of online interactive decision management tools, with three more added in 2017-18, joining the first two we launched in January 2017. Also known as decision trees, they help people break down complex information, mapping possible outcomes of a series of related choices or answers to questions.

In 2017-18, our five decision trees recorded 86,939 views. The most popular, with 52,835 views, was the decision tree launched in October 2017 that is helping people establish eligibility for the First Home Owner Grant.

They join other tools, like our online calculators, that are helping customers navigate their liability or eligibility for a range of taxes, grants, exemptions and concessions.

Private rulings

Another way we assist customers is to issue private rulings on requests where customers identify a tax technical or legislative issue making them uncertain of their liability.

In 2017-18, we:

- Issued 1207 private rulings or exemption request decisions, with 94 per cent completed within our 90-day target and 82 per cent completed within 60 days. This included determining 37 applications for exemption from foreign purchaser additional duty and 116 applications for exemption from the land tax absentee owner surcharge provisions, within an average of 40.9 days and 53 days respectively.

- Issued 89 landholder private rulings.

Our private rulings are in addition to our revenue rulings, which we issue and publish on our website as needed, to clarify how we interpret a particular law.

These public rulings:

- Represent our interpretation of a particular provision.

- Explain our current policies, guidelines and practices.

- Answer complex, commonly asked questions.